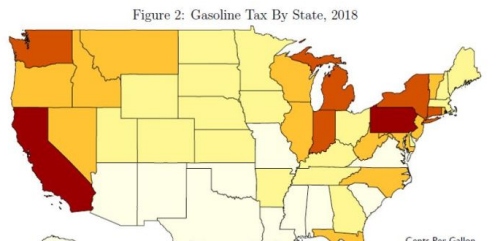

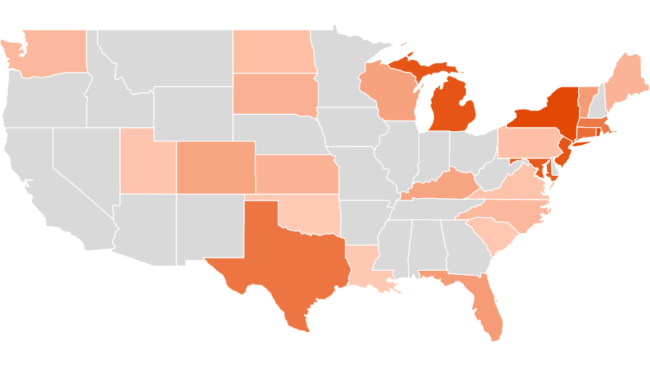

Gasoline Tax By State Map

How much does your state charge. It was a 1gal tax.

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

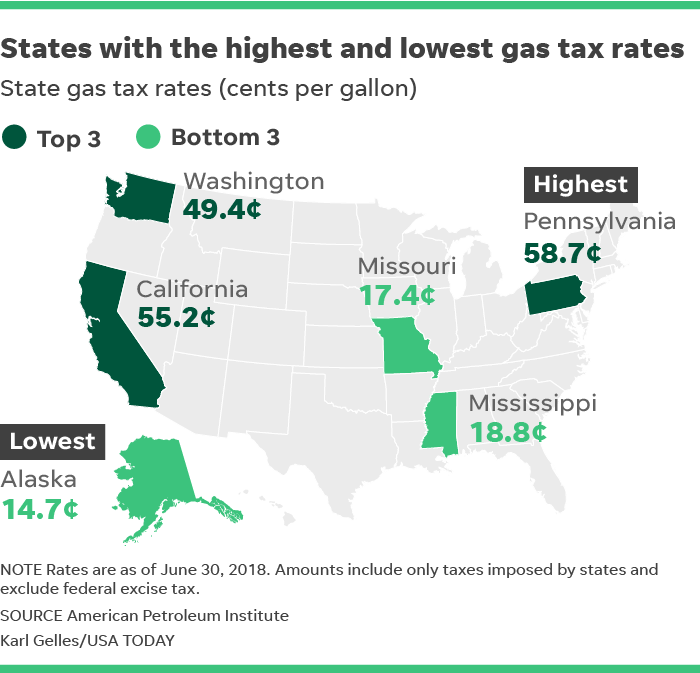

Stay Informed on Tax Policy Research and Analysis Pennsylvanias gas tax rate is highest at 587 cents per gallon followed by California 5522 cpg and Washington 494 cpg.

Gasoline tax by state map. Click on a state to see its state. California is a close runner up at 497 cents per gallon in state taxes Alaska has the lowest at 124 cents per gallon. State Sales Tax Rate Table.

Georgia Cigarette and Fuel Excise Taxes. State Sales Tax Map. Twenty-three states have.

Contact the Department of Revenue. By 1939 the many states levied an average fuel tax of 38gal 1L. State Sales Tax Rate Table.

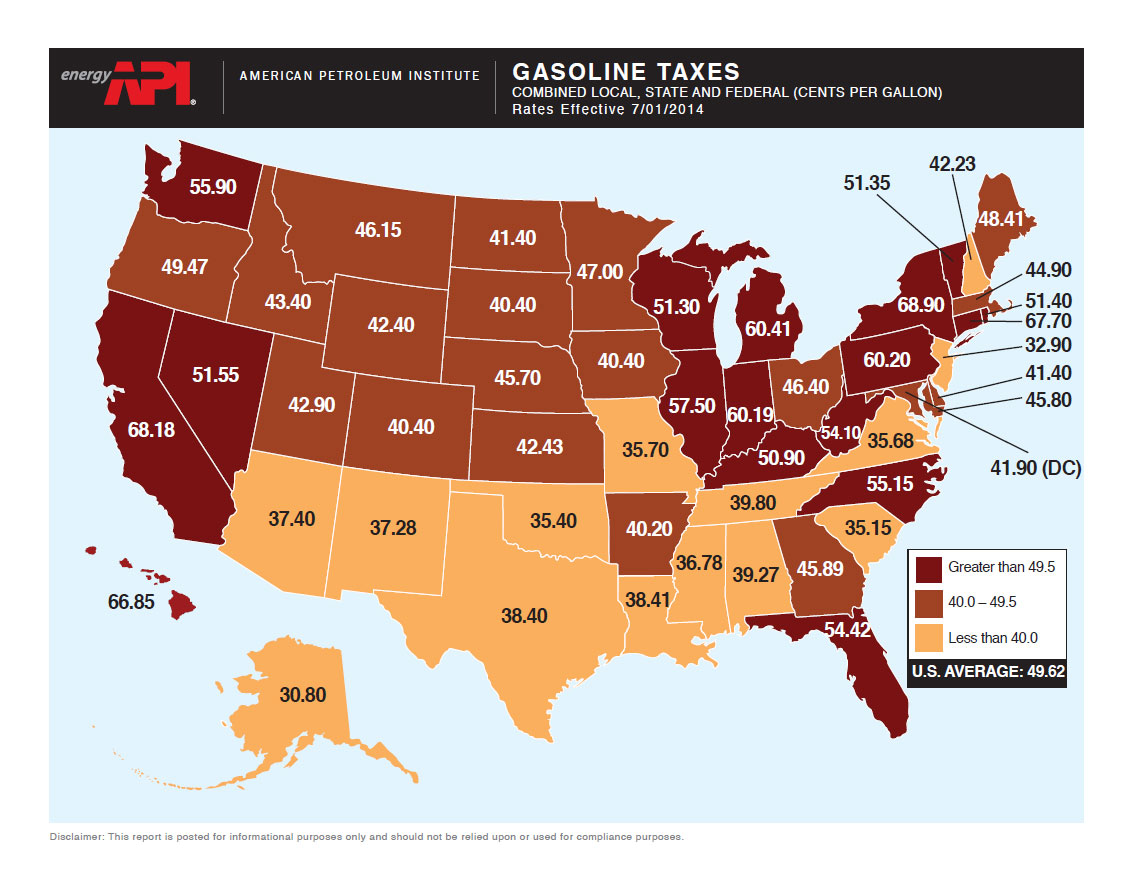

09072014 New York has the highest state and local taxes at 5050 per gallon. A map is available as well as a chart with information on each states gas tax and fees. Excise taxes on Fuel are implemented by every.

State tax rates and rules for income sales gas property cigarette and other taxes that impact middle-class families. Check out our interactive map to find out. Wisconsin Cigarette and Fuel Excise Taxes.

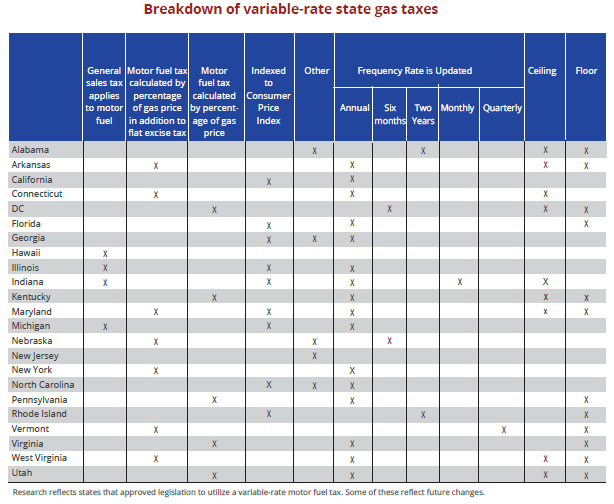

List of Sales Tax Holidays. Contact the Department of Revenue. 2020 This document provides general information on some of the variable rate strategies states are using to fund transportation investments.

52 rows The state with the lowest tax rate on gasoline is Alaska at 00895 gallon. That breaks down the gasoline tax regimes in the 50 states and the District of Columbia. The first US state to tax fuel was Oregon and was introduced on February 25 1919.

State Sales Tax Map. Contact the Department of Revenue. List of Sales Tax Holidays.

State Sales Tax Rate Table. Notes to State Motor Fuel Excise Tax Report January 2021. Gasoline Tax For more detailed information please view.

List of Sales Tax Holidays. The highest state gas tax is assessed in Pennsylvania at 582 cents per gallon with Washington State 494 cpg and Hawaii 4439 cpg following closely behind. State Sales Tax Map.

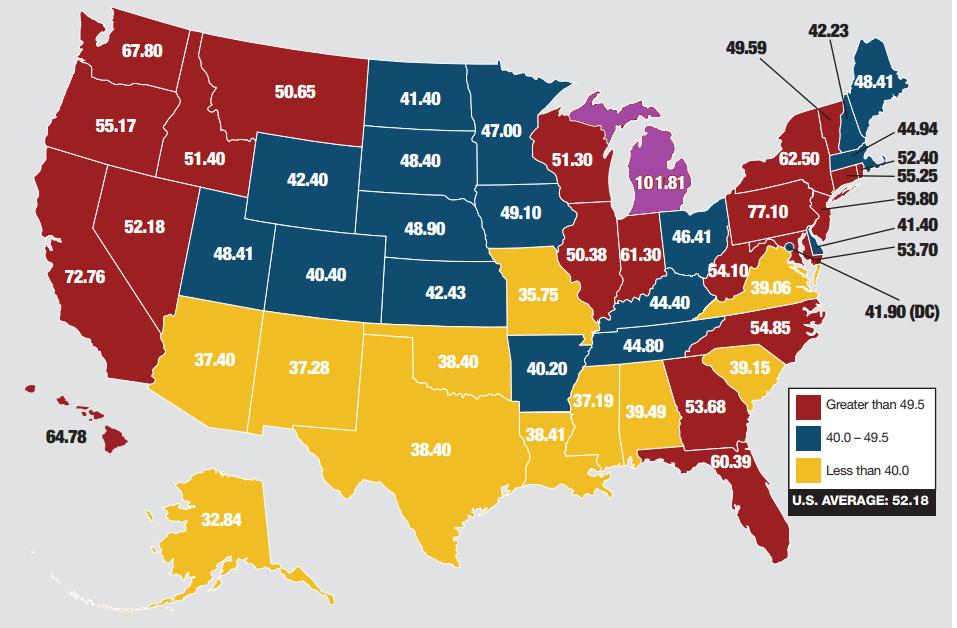

A variable-rate gasoline tax is a tax which adjusts the cents. NH VT RI NJ DE MD DC MA CT HI AK FL ME NY PA VA WV OH IN IL WI NC TN AR MO GA SC KY AL LA MS IA MN OK TX NM KS NE SD ND WY MT CO UT AZ NV OR WA ID CA MI Greater than 495. These taxes can vary widely.

Scroll down to view the full report. The American Petroleum Institute offers a handy map of the US. In the years since being created state fuel taxes have undergone many.

Excise taxes on Fuel are implemented by every. In addition to or instead of traditional sales taxes gasoline and other Fuel products are subject to excise taxes on both the Wisconsin and Federal levels. Click on any state in the map below for a detailed summary of state taxes.

The lowest gas tax rate is found in Alaska at 1465 cents per gallon followed by Missouri 1735 cpg and Mississippi 1879. The differences are strictly regional. GASOLINE TAXES COMBINED LOCAL STATE AND FEDERAL CENTS PER GALLON RATES.

27012017 This weeks map shows the gas tax rate in each state as of January 1 2017 using data from the American Petroleum Institute. Variable-Rate State Gas Taxes Report updated Feb. In addition to or instead of traditional sales taxes gasoline and other Fuel products are subject to excise taxes on both the Arizona and Federal levels.

Recent Tax Rate Changes. Recent Tax Rate Changes. California pumps out the highest tax rate of 612 cents per gallon followed by Pennsylvania 587 cpg Illinois 5498 cpg and Washington 494 cpg.

Excise taxes on Fuel are implemented by. Arizona Cigarette and Fuel Excise Taxes. 23032012 The federal gas tax is 184 cents per gallon while states set their own gas taxes.

Since the federal gasoline tax is 184 cents per gallon coast-to-coast variations in total gasoline and excise taxes are the products of decisions made at the state county and local levels. Recent Tax Rate Changes. 51 rows The average gas tax by the state is 2915 cents per gallon.

Youll find the lowest gas tax in Alaska at 1466 cents per gallon followed by Missouri 1742 cpg and Mississippi 184 cpg. In the following decade all of the US states 48 at the time along with the District of Columbia introduced a gasoline tax. In addition to or instead of traditional sales taxes gasoline and other Fuel products are subject to excise taxes on both the Georgia and Federal levels.

Why Are Gas Taxes So High John Locke Foundation John Locke Foundation

Doe Average Annual Gasoline Taxes Paid Per Vehicle By State 2019 Green Car Congress

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcrqssau8ovte7wl4ow Tj5 Ni7rghunrpbkdpfmg Daidtxhjkr Usqp Cau

Monday Map State Gasoline Tax Rates Tax Foundation

Monday Map State Gasoline Tax Rates Tax Foundation

State Taxes On Gasoline And Diesel Average 27 Cents Per Gallon Today In Energy U S Energy Information Administration Eia

State Taxes On Gasoline And Diesel Average 27 Cents Per Gallon Today In Energy U S Energy Information Administration Eia

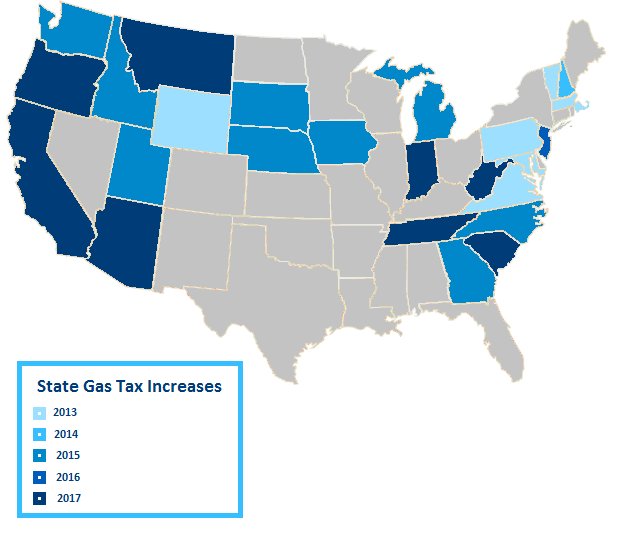

State Gas Tax Increases Since 1993 Metropolitan Transportation Commission

State Gas Tax Increases Since 1993 Metropolitan Transportation Commission

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctdo P Vspbbrvtjy5n5mzuoxecqypgucusnpzkmhdjl Qr Ni Usqp Cau

State Gasoline Taxes Average 23 5 Cents Per Gallon But Vary Widely Today In Energy U S Energy Information Administration Eia

State Gasoline Taxes Average 23 5 Cents Per Gallon But Vary Widely Today In Energy U S Energy Information Administration Eia

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Will The Highway Trust Fund Be Refilled Before It Runs Dry Don T Mess With Taxes

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

13 States Due For A Gas Tax Increase

13 States Due For A Gas Tax Increase

What Is The Gas Tax Rate Per Gallon In Your State Itep

What Is The Gas Tax Rate Per Gallon In Your State Itep

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

How Much Is My State Gas Tax Visual Ly

How Much Is My State Gas Tax Visual Ly

Should Electric Vehicle Drivers Pay A Mileage Tax Energy Post

Should Electric Vehicle Drivers Pay A Mileage Tax Energy Post

This Map Shows Where Gas Is Taxed The Most Time

This Map Shows Where Gas Is Taxed The Most Time

.png) Map State Gasoline Tax Rates Tax Foundation

Map State Gasoline Tax Rates Tax Foundation

Oregon Gas Tax Increase Asce S 2021 Infrastructure Report Card

Oregon Gas Tax Increase Asce S 2021 Infrastructure Report Card

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Prices Are Down But State Gas Excise Taxes Are Up This Thanksgiving Road Trip Season Don T Mess With Taxes

Recent Legislative Actions Likely To Change Gas Taxes

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Highway User Fees The Antiplanner

Highway User Fees The Antiplanner

Tax As Of Gas Price By State Valuewalk

Tax As Of Gas Price By State Valuewalk

Map How High Are Gas Taxes In Your State Vox

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Gas Taxes Bump Up Pump Prices But Not Enough To Stall A Record Number Of Memorial Day 2019 Drivers Don T Mess With Taxes

Feb 25 1919 Oregon Taxes Gas By The Gallon Wired

Feb 25 1919 Oregon Taxes Gas By The Gallon Wired

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

Patrick De Haan No Twitter 1 0181 Total Tax Per Gallon For Michigan Total Fed State Local Gas Taxes Cents Per Gallon By State If Michigan Were To Increase Gas Tax By 45c Gal Map

Patrick De Haan No Twitter 1 0181 Total Tax Per Gallon For Michigan Total Fed State Local Gas Taxes Cents Per Gallon By State If Michigan Were To Increase Gas Tax By 45c Gal Map

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

State Gasoline Tax Rates By The Tax Foundation Infographic Map Safest Places To Travel Safe Cities

State Gasoline Tax Rates By The Tax Foundation Infographic Map Safest Places To Travel Safe Cities

Tax Foundation On Twitter Traveling This Labordayweekend Find Out How High Gas Taxes Are In Your State Https T Co Grrhwhrdct Pa Levies The Highest Gas Tax Rate At Roughly 59 Cents Gallon Followed By Ca

Tax Foundation On Twitter Traveling This Labordayweekend Find Out How High Gas Taxes Are In Your State Https T Co Grrhwhrdct Pa Levies The Highest Gas Tax Rate At Roughly 59 Cents Gallon Followed By Ca

Rising Gas Taxes Which States Have Highest And Lowest Rates

Rising Gas Taxes Which States Have Highest And Lowest Rates

How Long Has It Been Since Your State Raised Its Gas Tax Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Pain At The Pump Eight States Increase Gas Tax Buchart Horn Engineers Architects And Planners

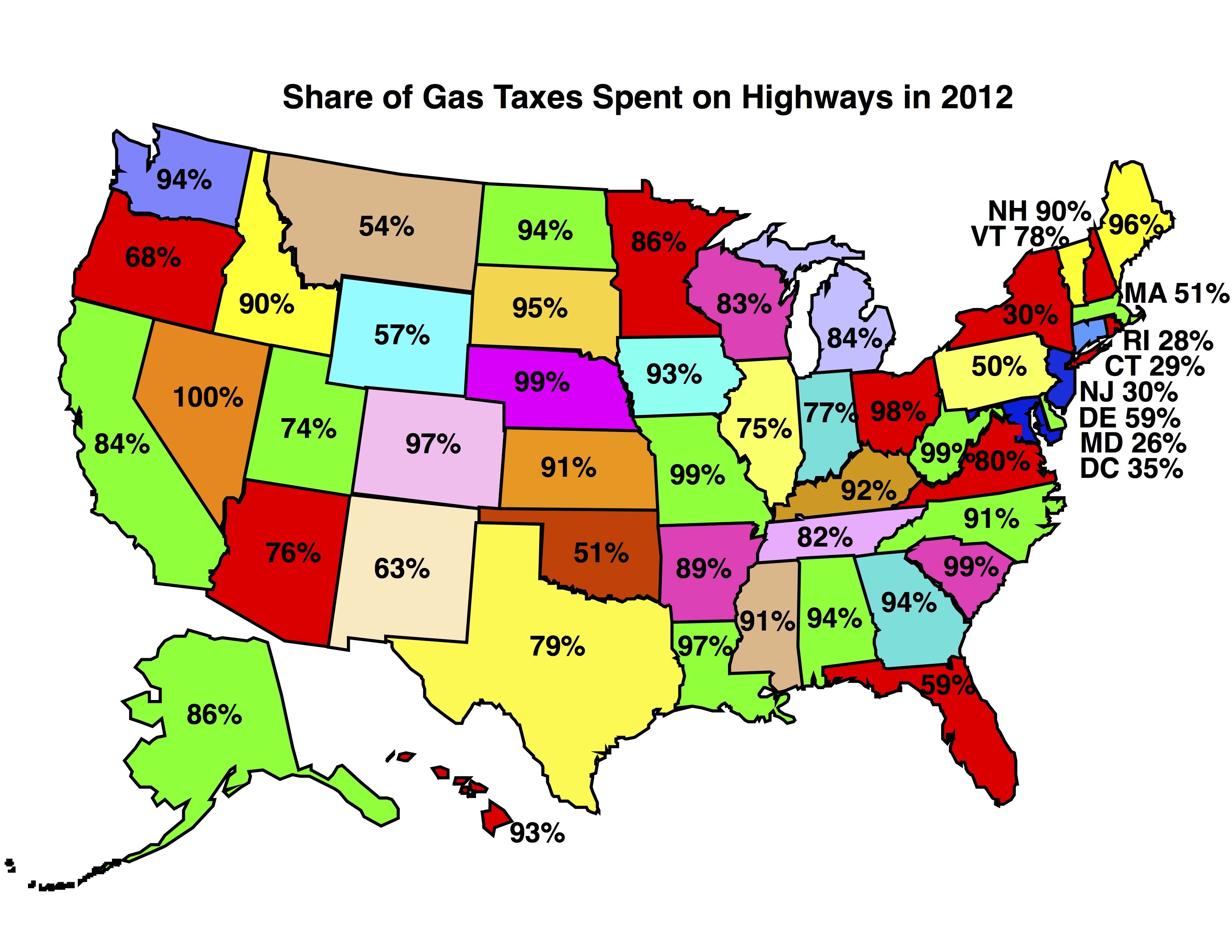

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

Top 10 Posts Of 2010 Tax Foundation

Top 10 Posts Of 2010 Tax Foundation

Memorial Day Drivers Undeterred By Gas Prices Taxes Don T Mess With Taxes

0 Response to "Gasoline Tax By State Map"

Post a Comment