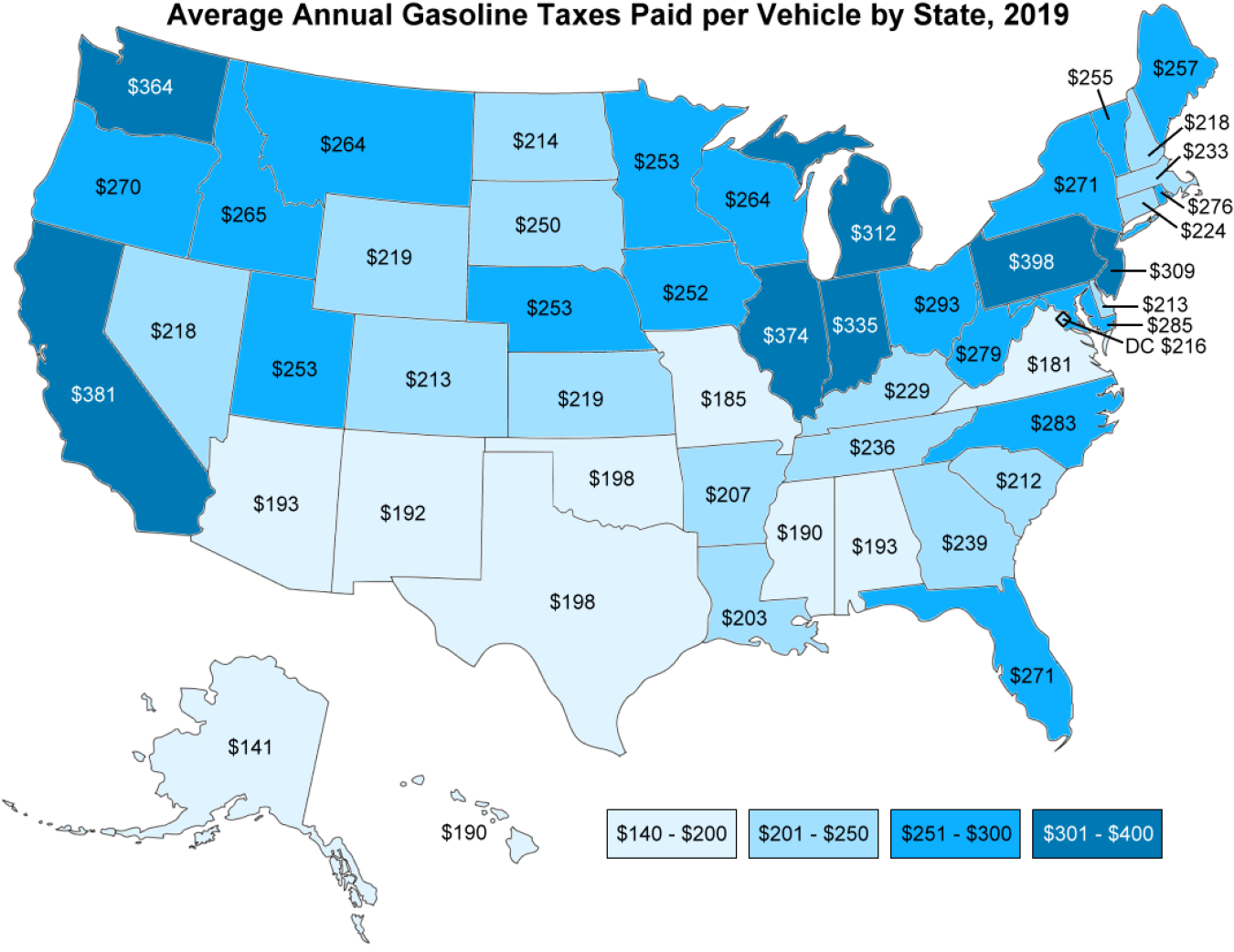

Gasoline Taxes By State Map

1022019 35819 PM. Total State TaxesFees 3683.

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

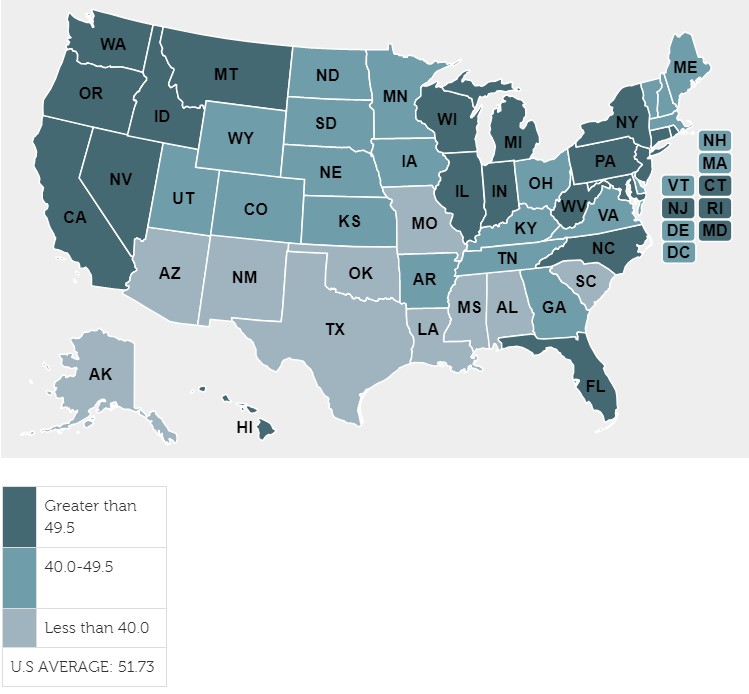

51 rows The average gas tax by the state is 2915 cents per gallon.

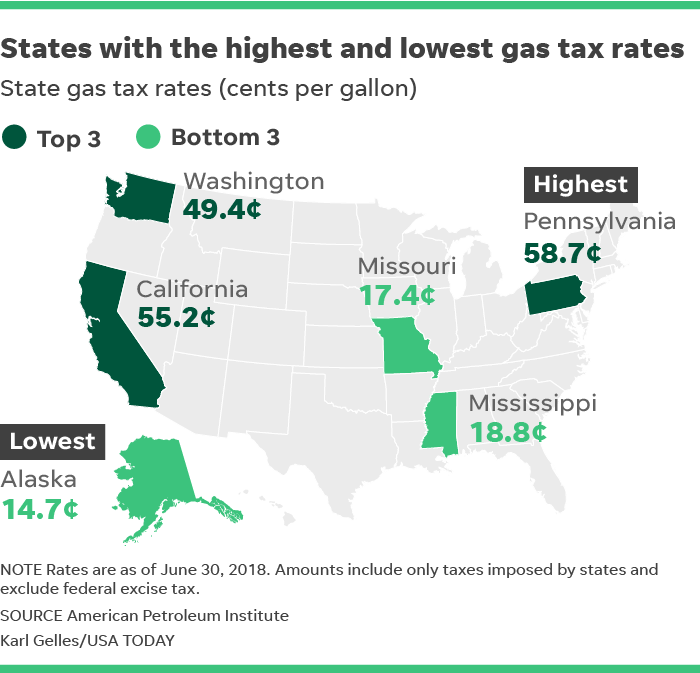

Gasoline taxes by state map. The State Motor Fuel Tax Report is posted on the Web for. In California the place with a high historical gas price by state the tax varies with inflation. 52 rows The state with the highest tax rate on gasoline is Pennsylvania at 0586 gallon.

Not all states have fixed gas taxes however 22 states and Washington DC have variable taxes that grow over time. 17052019 Compared to the sales tax applied to general goods and services motor-fuel levies exceed those states with the highest sales-tax rate 10 percent. Click on a state to see its state.

State Sales Tax Map. How much does your state charge. Other states with variable gas tax include Florida Hawaii Georgia New York and New Jersey.

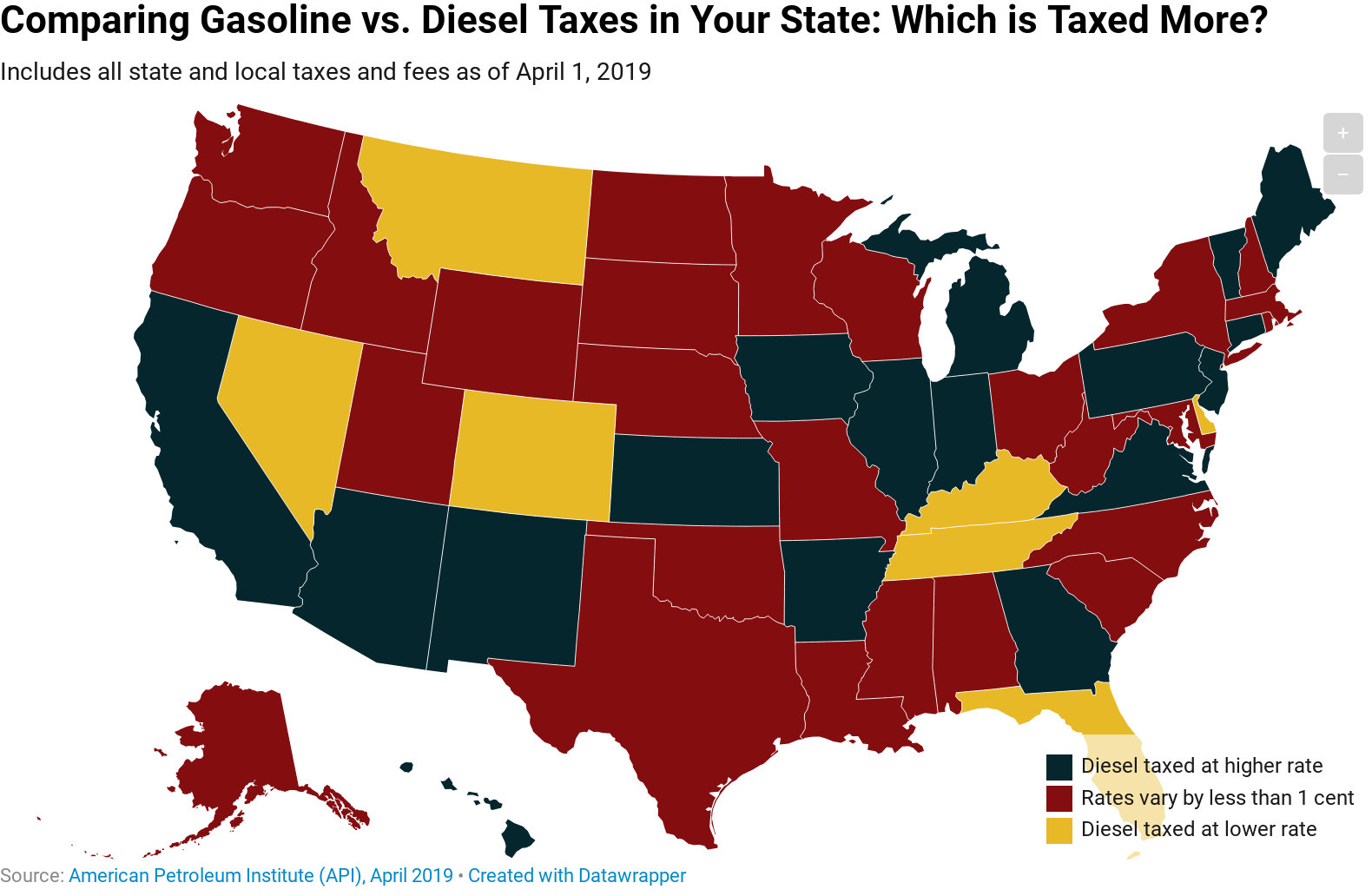

And for diesel as of April 2019. Interactive Gasoline Map January 2021 Interactive Diesel Map January 2021 Disclaimer. Per gallon The national average is volume weighted and takes into account fuel consumption in each state.

The lowest gas tax rate is found in Alaska at 1465 cents per gallon followed by Missouri 1735 cpg and Mississippi 1879. Arizona Cigarette and Fuel Excise Taxes. List of Sales Tax Holidays.

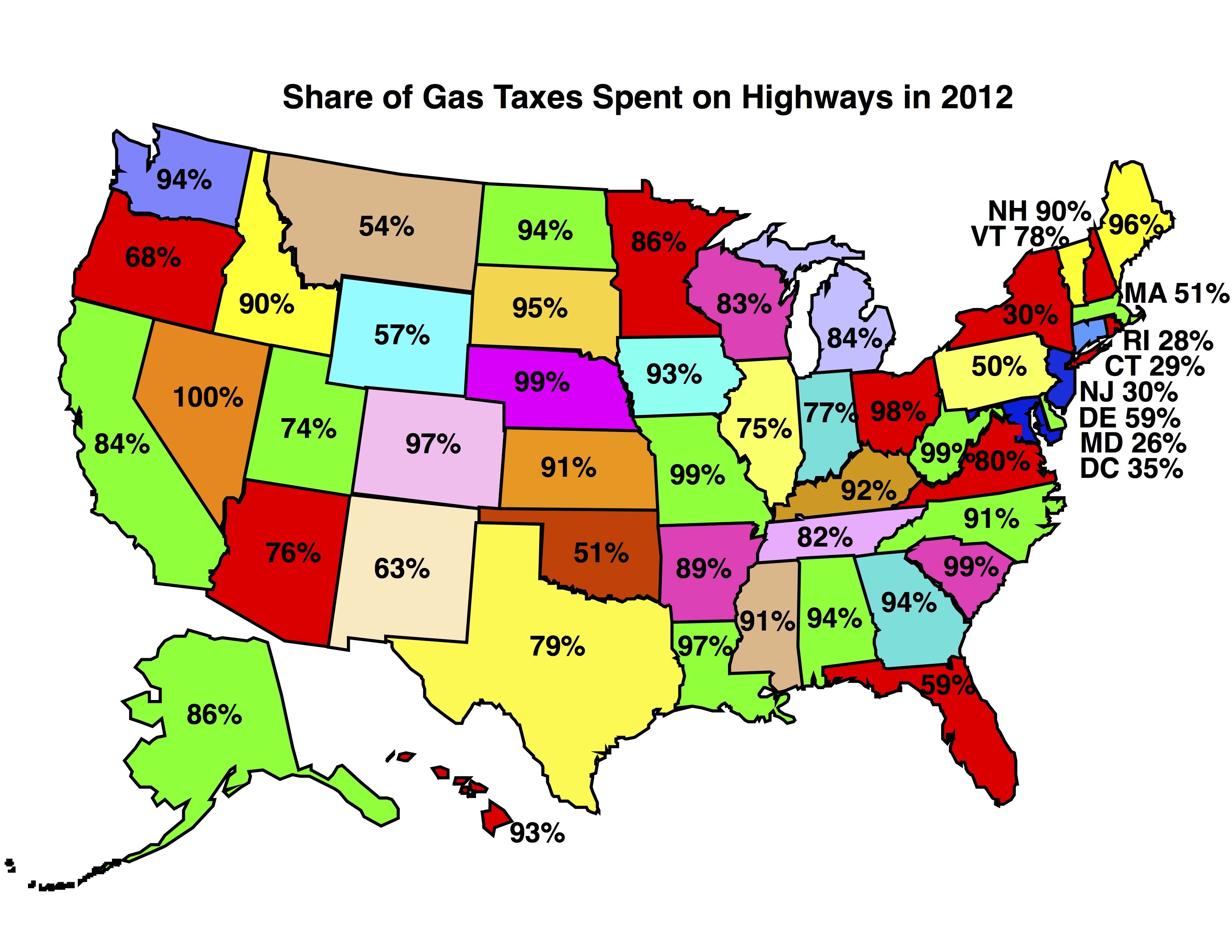

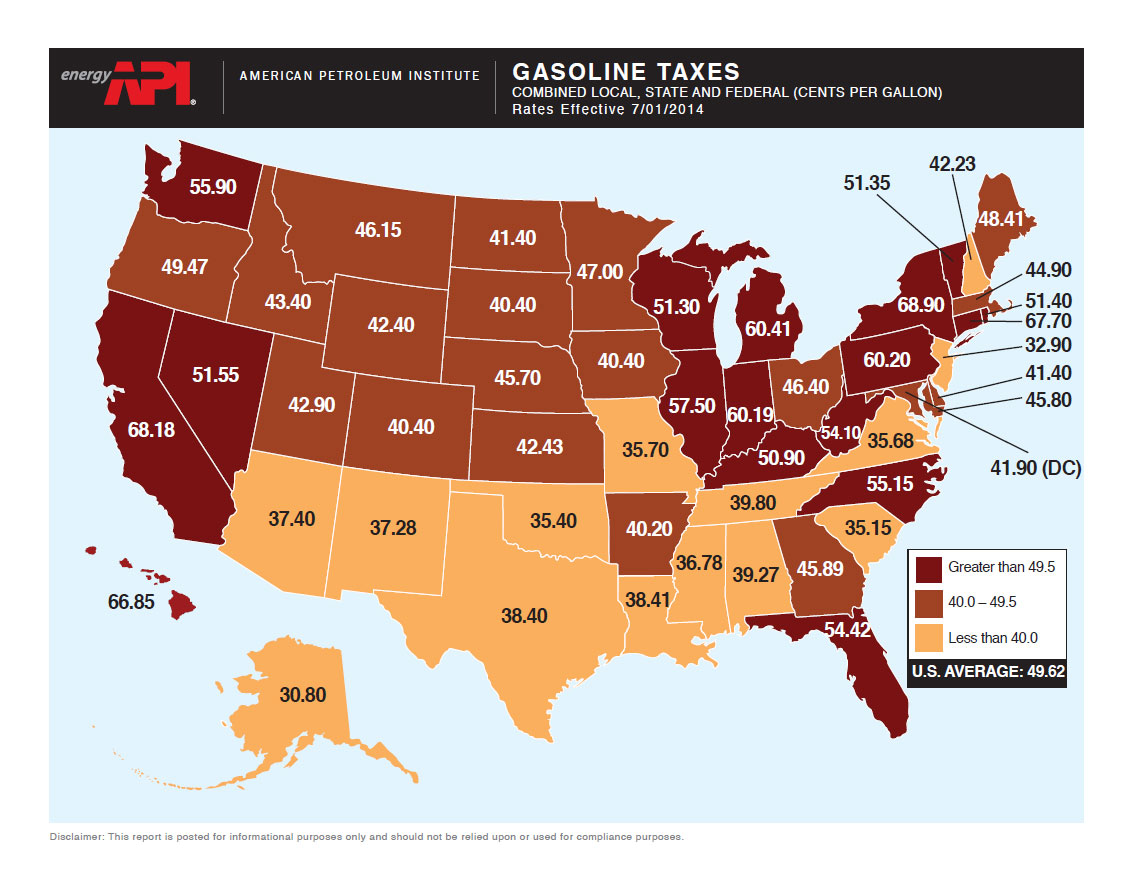

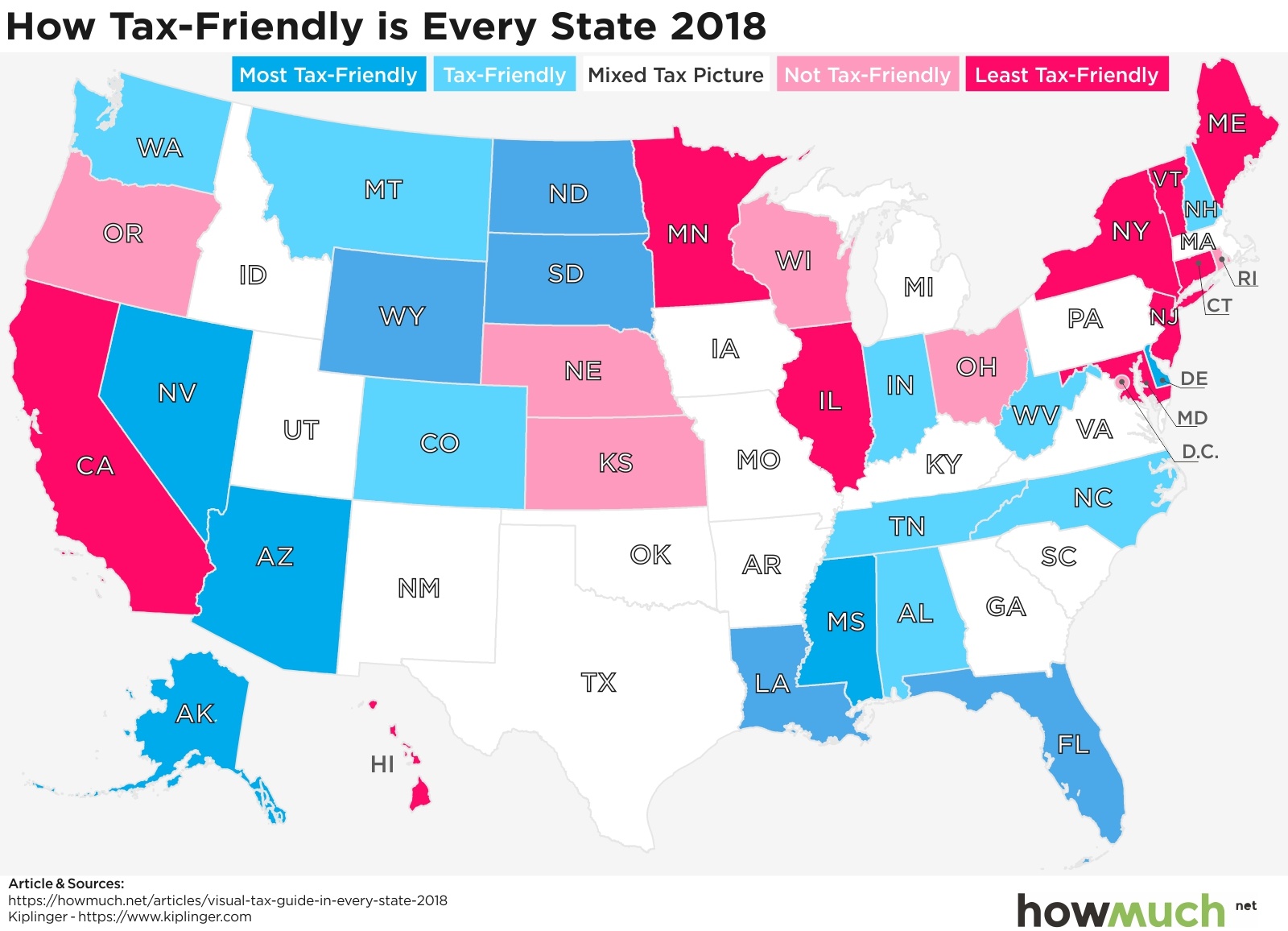

But several readers didnt want the conclusion left up in the air they preferred to see how highway and gas taxes actually played out across the states so I located the following map at the American Petroleum Institutes website. State-by-State Guide to Taxes on Middle-Class Families Click on any state in the map below for a detailed summary of state taxes on income property and items you buy on a daily basis. Check out our interactive map to find out.

In addition to or instead of traditional sales taxes gasoline and other Fuel products are subject to excise taxes on both the Arizona and Federal levels. Contact the Department of Revenue. California is a close runner up at 497 cents per gallon in state taxes Alaska has the lowest at 124 cents per gallon.

Click on the map or links below to see interactive gasoline and diesel maps which include latest quarterly information on state local and federal taxes on motor fuels. California pumps out the highest tax rate of 612 cents per gallon followed by Pennsylvania 587 cpg Illinois 5498 cpg and Washington 494 cpg. 09072014 New York has the highest state and local taxes at 5050 per gallon.

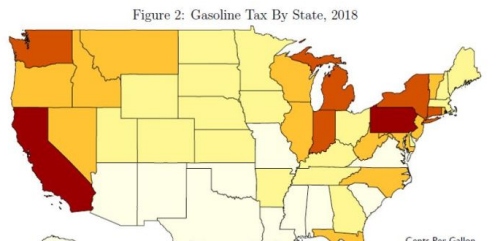

The map below from API shows the state-by-state breakdown for gasoline as of April 2019. Pennsylvanias gas tax rate is highest at 587 cents per gallon followed by California 5522 cpg and Washington 494 cpg. Twenty-three states have.

The federal tax was last raised October 1 1993 and is not indexed to inflation which increased by a total of 77 percent from 1993 until 2020On average as of April 2019 state and local taxes and fees add 3424 cents to gasoline and 3589 cents to diesel for a total US. 27012017 These taxes can vary widely. Alaska drivers pay the lowest rate in the country at 1225 cents per gallon.

Total State and Federal Taxes. 20082014 Gasoline Taxes by State. The highest state gas tax is assessed in Pennsylvania at 582 cents per gallon with Washington State 494 cpg and Hawaii 4439 cpg following closely behind.

Recent Tax Rate Changes. According to their information the nationwide average is. Youll find the lowest gas tax in Alaska at 1466 cents per gallon followed by Missouri 1742 cpg and Mississippi 184 cpg.

In most states taxes vary either with the USA average gas prices or inflation. The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel. State Sales Tax Rate Table.

GASOLINE TAXES COMBINED LOCAL STATE AND FEDERAL CENTS PER GALLON RATES EFFECTIVE 01012020 Lorem ipsum. Interactive Maps Showing Gasoline and Diesel Taxes. Pennsylvania lowered taxes by six tenths of a cent but the state still has the highest gas taxes in the countryJust as the cost of gasoline varies considerably from state to state so does the.

On it we can see which states have high medium or low taxes. 23032012 The federal gas tax is 184 cents per gallon while states set their own gas taxes. These figures do not include the 184 cpg federal gas tax.

Excise taxes on Fuel are implemented by every.

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Highway User Fees The Antiplanner

Highway User Fees The Antiplanner

Gas Prices Are Down But State Gas Excise Taxes Are Up This Thanksgiving Road Trip Season Don T Mess With Taxes

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

How Much Is My State Gas Tax Visual Ly

How Much Is My State Gas Tax Visual Ly

This Map Shows Where Gas Is Taxed The Most Time

This Map Shows Where Gas Is Taxed The Most Time

State Taxes On Gasoline And Diesel Average 27 Cents Per Gallon Today In Energy U S Energy Information Administration Eia

State Taxes On Gasoline And Diesel Average 27 Cents Per Gallon Today In Energy U S Energy Information Administration Eia

Why Are Gas Taxes So High John Locke Foundation John Locke Foundation

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

When Did Your State Adopt Its Gas Tax Tax Foundation

When Did Your State Adopt Its Gas Tax Tax Foundation

Memorial Day Drivers Undeterred By Gas Prices Taxes Don T Mess With Taxes

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png) States That Do Not Tax Earned Income

States That Do Not Tax Earned Income

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

State Taxes On Gasoline And Diesel Average 27 Cents Per Gallon Today In Energy U S Energy Information Administration Eia

State Taxes On Gasoline And Diesel Average 27 Cents Per Gallon Today In Energy U S Energy Information Administration Eia

.png) Map State Gasoline Tax Rates Tax Foundation

Map State Gasoline Tax Rates Tax Foundation

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

State Gasoline Tax Rates By The Tax Foundation Infographic Map Safest Places To Travel Safe Cities

State Gasoline Tax Rates By The Tax Foundation Infographic Map Safest Places To Travel Safe Cities

Should Electric Vehicle Drivers Pay A Mileage Tax Energy Post

Should Electric Vehicle Drivers Pay A Mileage Tax Energy Post

13 States Due For A Gas Tax Increase

13 States Due For A Gas Tax Increase

Top 10 Posts Of 2010 Tax Foundation

Top 10 Posts Of 2010 Tax Foundation

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

What Is The Gas Tax Rate Per Gallon In Your State Itep

What Is The Gas Tax Rate Per Gallon In Your State Itep

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

State Taxes And Fees On Gasoline As Of July 1 2017 Flickr

State Taxes And Fees On Gasoline As Of July 1 2017 Flickr

State Gas Tax Increases Since 1993 Metropolitan Transportation Commission

State Gas Tax Increases Since 1993 Metropolitan Transportation Commission

Gasoline Vs Diesel Taxes In Your State Which Is Taxed More Itep

Gasoline Vs Diesel Taxes In Your State Which Is Taxed More Itep

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Map How High Are Gas Taxes In Your State Vox

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcrqssau8ovte7wl4ow Tj5 Ni7rghunrpbkdpfmg Daidtxhjkr Usqp Cau

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Rising Gas Taxes Which States Have Highest And Lowest Rates

Rising Gas Taxes Which States Have Highest And Lowest Rates

Recent Legislative Actions Likely To Change Gas Taxes

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctdo P Vspbbrvtjy5n5mzuoxecqypgucusnpzkmhdjl Qr Ni Usqp Cau

State Gasoline Taxes Average 23 5 Cents Per Gallon But Vary Widely Today In Energy U S Energy Information Administration Eia

State Gasoline Taxes Average 23 5 Cents Per Gallon But Vary Widely Today In Energy U S Energy Information Administration Eia

Api Taxes And Regulations Impact Pump Prices

Api Taxes And Regulations Impact Pump Prices

Monday Map State Gasoline Tax Rates Tax Foundation

Monday Map State Gasoline Tax Rates Tax Foundation

Feb 25 1919 Oregon Taxes Gas By The Gallon Wired

Feb 25 1919 Oregon Taxes Gas By The Gallon Wired

State Motor Fuels Tax Rates Tax Policy Center

State Motor Fuels Tax Rates Tax Policy Center

0 Response to "Gasoline Taxes By State Map"

Post a Comment