Gas Tax By State Map

State sales taxes may not be utilized for transportation purposes but can impact the price of gasoline at the pump. The first US state to tax fuel was Oregon and was introduced on February 25 1919.

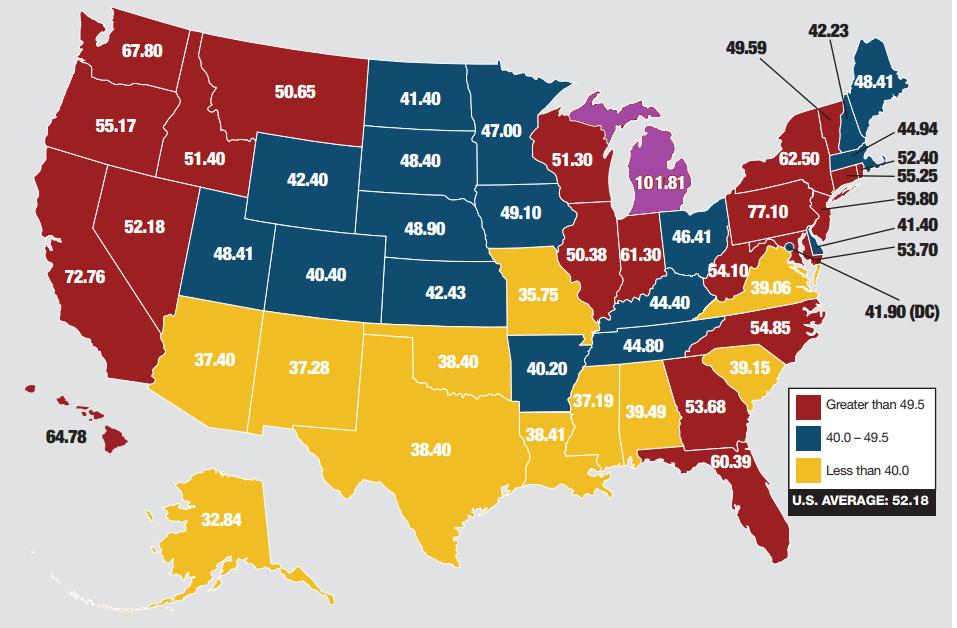

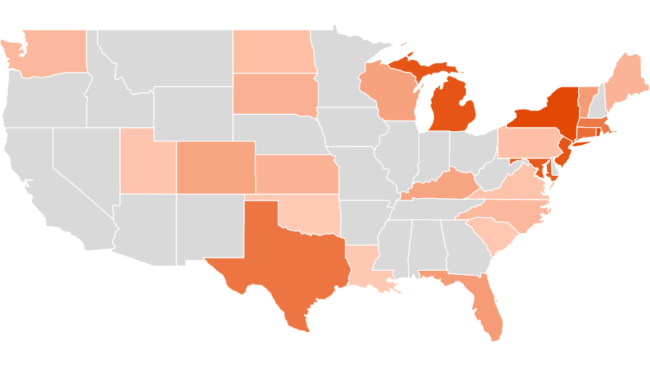

State Taxes On Gasoline In 2017 Up 4 5 From 2016 Today In Energy U S Energy Information Administration Eia

State Taxes On Gasoline In 2017 Up 4 5 From 2016 Today In Energy U S Energy Information Administration Eia

Gas tax by state with border differences highlighted.

Gas tax by state map. 1 2015 2 increases the dedicated share of existing general sales tax revenues used for. 5485 cents per gallon. It was a 1gal tax.

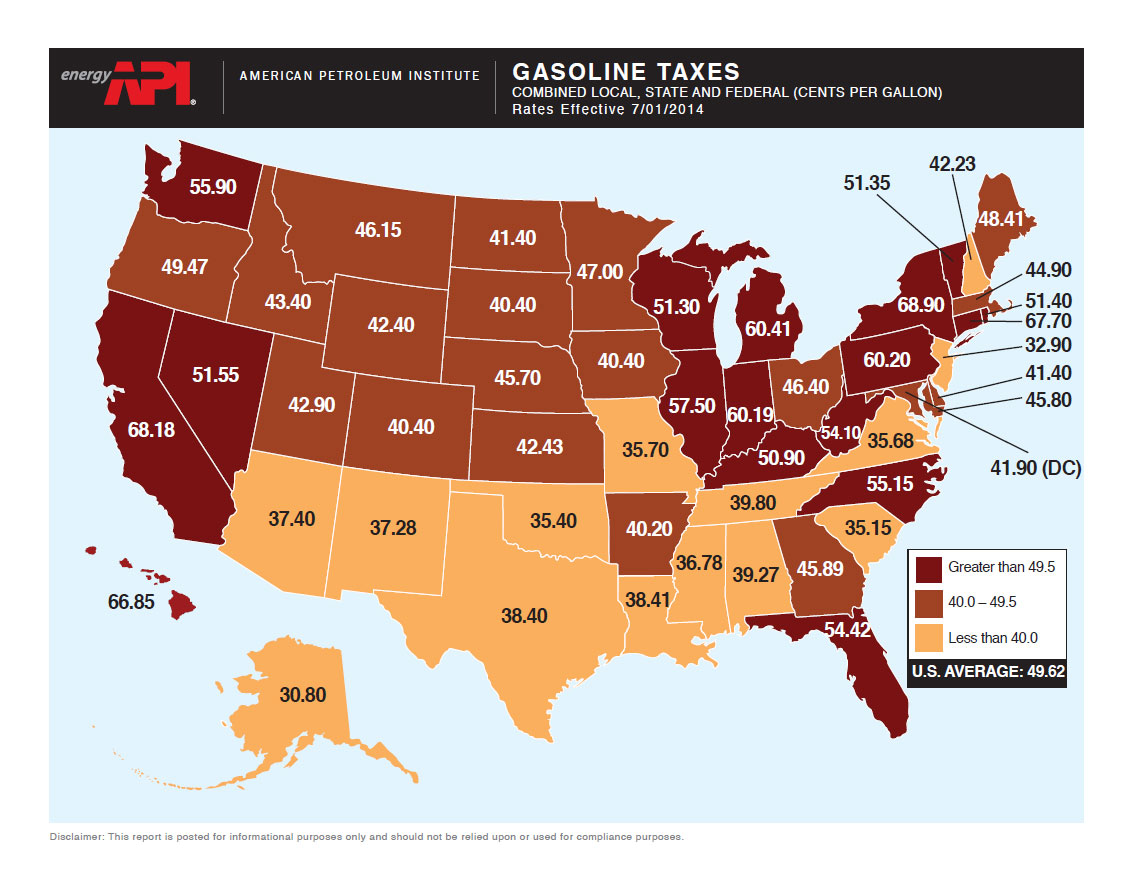

The tax exemption information provided is the most current information as of the date indicated on each individual State map page bottom left hand corner. Every week we release a new tax map that illustrates one important measure of state tax rates collections burdens and more. 09072014 New York has the highest state and local taxes at 5050 per gallon.

California is now in 1st place with the highest rate of 532 cents per gallon and is followed closely by Hawaii 503 centsgallon New York 499. Total State and Federal Taxes. Should you become aware of.

California is a close runner up at 497 cents per gallon in state taxes Alaska has the lowest at 124 cents per gallon. 51 rows The Gas Tax by state ranges from 00895 in Alaska to 0586 in Pennsylvania. The highest state gas tax is assessed in Pennsylvania at 582 cents per gallon with Washington State 494 cpg and Hawaii 4439 cpg following closely behind.

Indiana Illinois and Michigan also levy the state sales tax on fuel purchases in addition to another variable-rate component. In the following decade all of the US states 48 at the time along with the District of Columbia introduced a gasoline taxBy 1939 the many states levied an average fuel tax of 38gal 1L. 27012017 This weeks map shows the gas tax rate in each state as of January 1 2017 using data from the American Petroleum Institute.

Hawaii charges a general state sales and use tax in addition to a flat excise tax on gasoline. 188 cents per gallon. 81 percent sixth lowest Percent of roadway in sub-optimal.

North Carolina drivers pay gasoline taxes that are slightly higher than what the American Petroleum Institute says is the national average. Also check out the tax-specific slideshows listed below the map. If you enjoy our weekly tax maps help us continue this work and more by making a small contribution here.

Click on any state in the map below for a detailed summary of state taxes on income property and items you buy on a daily basis. Thats almost two-and-a-half-times as much as in the lowest-tax state Alaska where motorists will pay just a little bit under 30 cents per gallon in taxes when they buy gasoline. The data comes from a recently updated report by the American Petroleum Institute and there are some interesting changes since our last map on gas taxes.

The states share of the fuel tax used to move up or down every six months in step with wholesale fuel prices. 21102020 Weve found that one of the best most engaging ways to do that is by visualizing tax data in the form of maps. The information provided by each state may change without notice to the GSA Center for Charge Card Management.

Enable JavaScript to see Google Maps. 52 rows The state with the lowest tax rate on gasoline is Alaska at 00895 gallon followed. 231 per gallon fourth lowest State and federal taxes as percent of gas price.

28042015 A motorist filling up in the Keystone State can now expect to pay 70 cents in gasoline taxes for each gallon purchased the most in the nation. 5457 cents per gallon. These taxes can vary widely.

Total State TaxesFees 3683. When you have eliminated the JavaScript whatever remains must be an empty page. 29102013 This weeks Monday Map takes a look at state gasoline tax rates.

12082020 In place of the previous 175 cents-per-gallon tax the bill 1 establishes a percentage-of-wholesale-price tax of 35 percent for gasoline and 6 percent for diesel with additional rate increases contingent on whether federal legislation on out-of-state sales tax collection is enacted by Jan. Select the State in the Map to Find Tax Exempt Status. 31072019 These rates vary widely from state to state and can be seen in the map below.

Find local businesses view maps and get driving directions in Google Maps. California pumps out the highest tax rate of 612 cents per gallon followed by Pennsylvania 587 cpg Illinois 5498 cpg and Washington 494 cpg.

Oregon Gas Tax Increase Asce S 2021 Infrastructure Report Card

Oregon Gas Tax Increase Asce S 2021 Infrastructure Report Card

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

.png) Map State Gasoline Tax Rates Tax Foundation

Map State Gasoline Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Gas Taxes Bump Up Pump Prices But Not Enough To Stall A Record Number Of Memorial Day 2019 Drivers Don T Mess With Taxes

Gas Prices Are Down But State Gas Excise Taxes Are Up This Thanksgiving Road Trip Season Don T Mess With Taxes

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

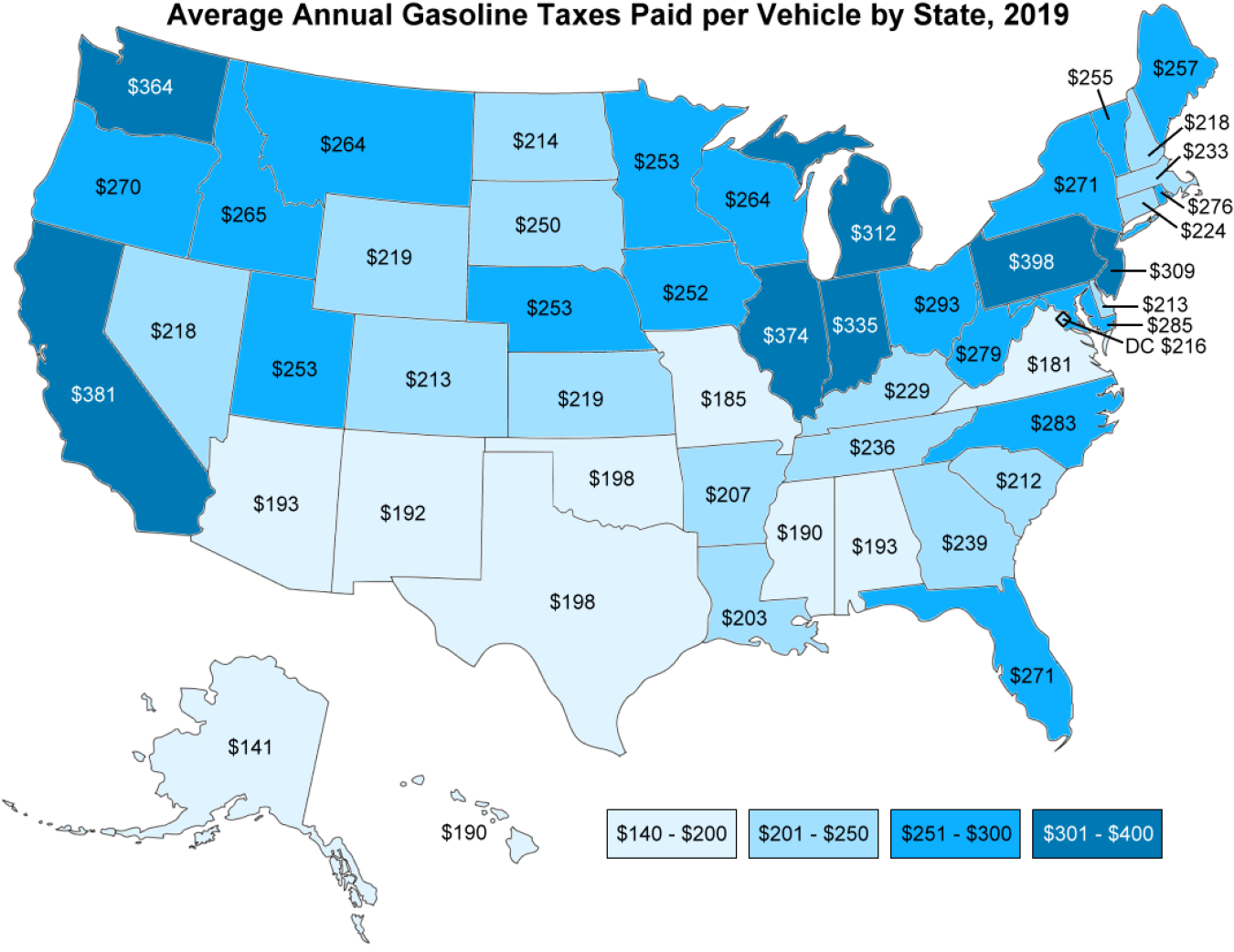

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

Patrick De Haan No Twitter 1 0181 Total Tax Per Gallon For Michigan Total Fed State Local Gas Taxes Cents Per Gallon By State If Michigan Were To Increase Gas Tax By 45c Gal Map

Patrick De Haan No Twitter 1 0181 Total Tax Per Gallon For Michigan Total Fed State Local Gas Taxes Cents Per Gallon By State If Michigan Were To Increase Gas Tax By 45c Gal Map

Tax Foundation On Twitter Traveling This Labordayweekend Find Out How High Gas Taxes Are In Your State Https T Co Grrhwhrdct Pa Levies The Highest Gas Tax Rate At Roughly 59 Cents Gallon Followed By Ca

Tax Foundation On Twitter Traveling This Labordayweekend Find Out How High Gas Taxes Are In Your State Https T Co Grrhwhrdct Pa Levies The Highest Gas Tax Rate At Roughly 59 Cents Gallon Followed By Ca

State And Local Sales Tax Rates 2018 Tax Foundation

State And Local Sales Tax Rates 2018 Tax Foundation

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

State Level Retail Gasoline Taxes Vary Significantly Today In Energy U S Energy Information Administration Eia

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

State Taxes On Gasoline And Diesel Average 27 Cents Per Gallon Today In Energy U S Energy Information Administration Eia

State Taxes On Gasoline And Diesel Average 27 Cents Per Gallon Today In Energy U S Energy Information Administration Eia

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

When Did Your State Adopt Its Gas Tax Tax Foundation

When Did Your State Adopt Its Gas Tax Tax Foundation

13 States Due For A Gas Tax Increase

13 States Due For A Gas Tax Increase

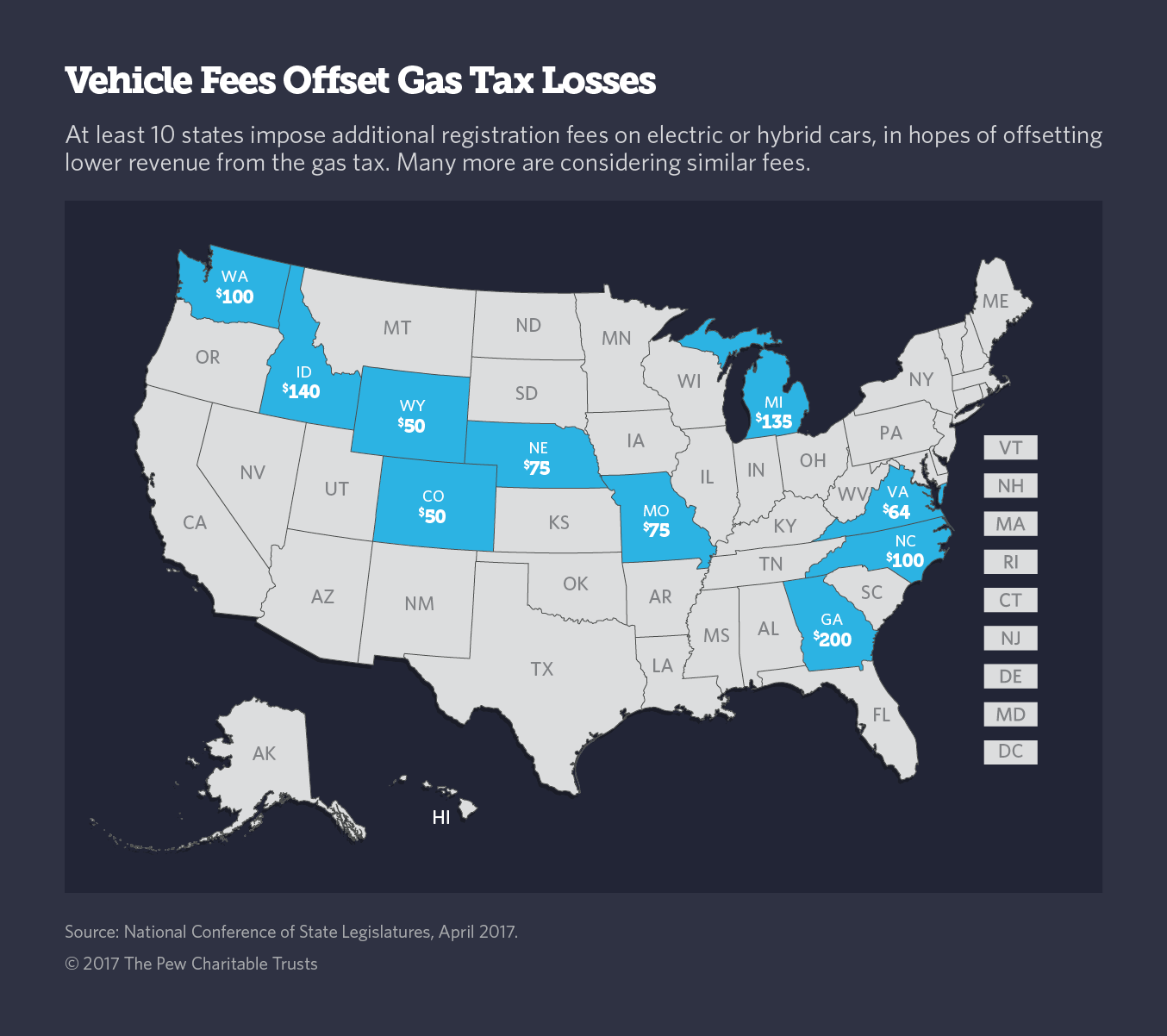

Amid Gas Tax Revenue Decline New Fees On Fuel Efficient Cars The Pew Charitable Trusts

Amid Gas Tax Revenue Decline New Fees On Fuel Efficient Cars The Pew Charitable Trusts

This Map Shows Where Gas Is Taxed The Most Time

This Map Shows Where Gas Is Taxed The Most Time

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Recent Legislative Actions Likely To Change Gas Taxes

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcrqssau8ovte7wl4ow Tj5 Ni7rghunrpbkdpfmg Daidtxhjkr Usqp Cau

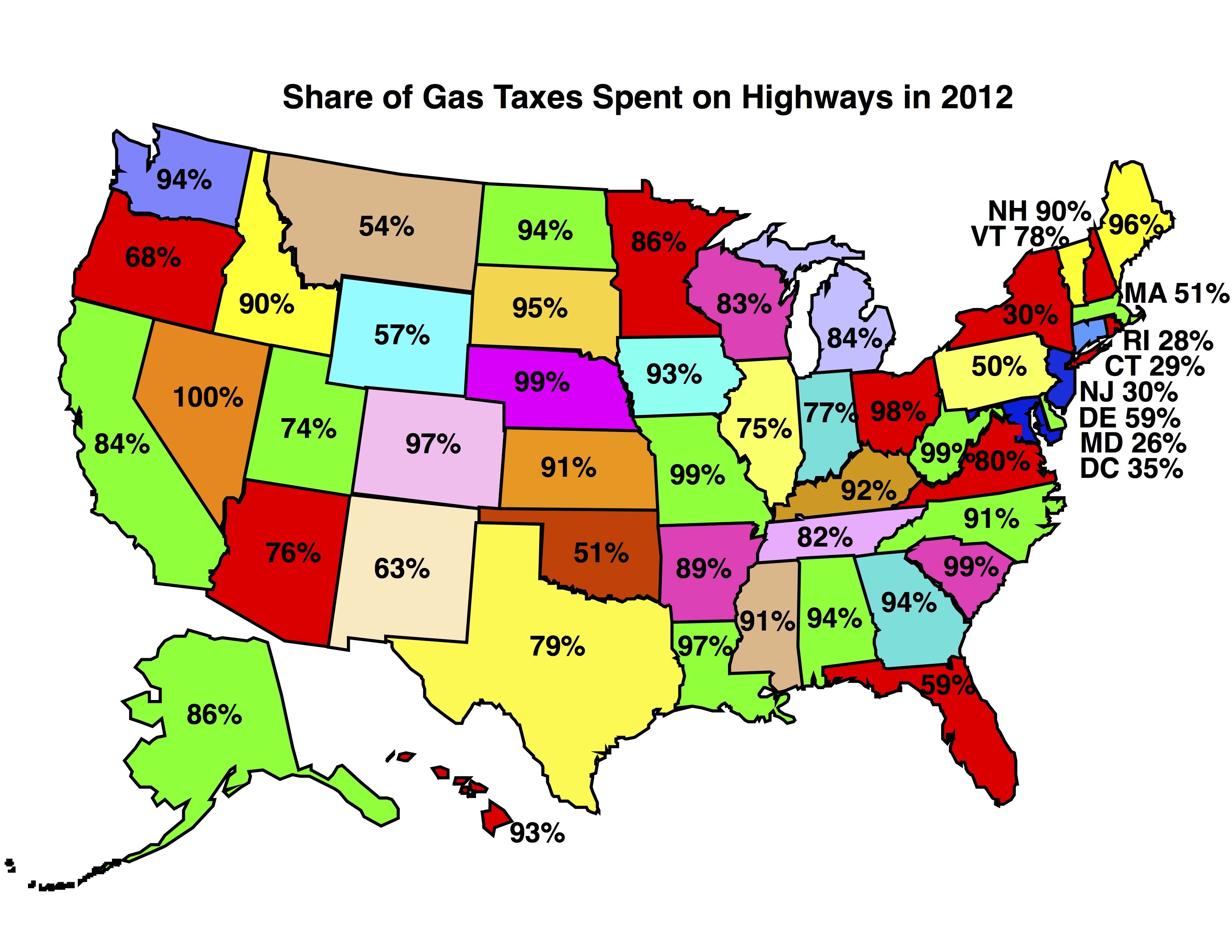

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Pain At The Pump Eight States Increase Gas Tax Buchart Horn Engineers Architects And Planners

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

Download Phase State Diagram For Gasoline Full Hd Version Grafica05 Victortupelo Nl

Download Phase State Diagram For Gasoline Full Hd Version Grafica05 Victortupelo Nl

Memorial Day Drivers Undeterred By Gas Prices Taxes Don T Mess With Taxes

How Much Is My State Gas Tax Visual Ly

How Much Is My State Gas Tax Visual Ly

Map How High Are Gas Taxes In Your State Vox

A Foolish Take Which States Have The Highest And Lowest Gasoline Taxes The Motley Fool Gas Tax The Motley Fool State Tax

A Foolish Take Which States Have The Highest And Lowest Gasoline Taxes The Motley Fool Gas Tax The Motley Fool State Tax

Feb 25 1919 Oregon Taxes Gas By The Gallon Wired

Feb 25 1919 Oregon Taxes Gas By The Gallon Wired

Top 10 Posts Of 2010 Tax Foundation

Top 10 Posts Of 2010 Tax Foundation

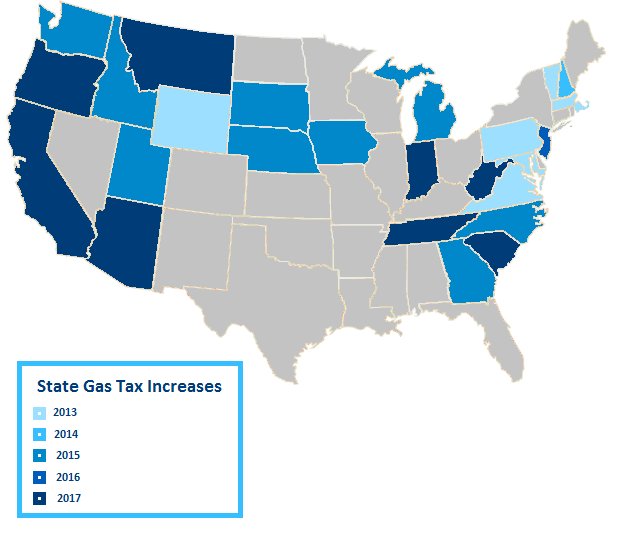

State Gas Tax Increases Since 1993 Metropolitan Transportation Commission

State Gas Tax Increases Since 1993 Metropolitan Transportation Commission

Fuel Taxes In The United States Wikiwand

Fuel Taxes In The United States Wikiwand

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

Cumberland Advisors Market Commentary The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Cumberland Advisors

Cumberland Advisors Market Commentary The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Cumberland Advisors

Tax As Of Gas Price By State Valuewalk

Tax As Of Gas Price By State Valuewalk

Highway User Fees The Antiplanner

Highway User Fees The Antiplanner

Why Are Gas Taxes So High John Locke Foundation John Locke Foundation

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctdo P Vspbbrvtjy5n5mzuoxecqypgucusnpzkmhdjl Qr Ni Usqp Cau

0 Response to "Gas Tax By State Map"

Post a Comment